Last year I wrote about the career of Bimal Patel. I have been meaning to add to that post, because there are a number of other banking lawyers with interesting careers, including one who is having a huge impact on the day to day lives of Americans.

To review Bimal's career, he had a keen desire for money. But he couldn't make it at O'Melveny because he had few or no clients. O'Melveny's "eat what you kill" culture only pays those who produce billable hours. So he devised a scheme to, in his words, "monetize" government positions into a lucrative salary. You can read the details in that prior post.

Now take a look at Citadel's general counsel Heath Tarbert. Before chronicling his career, I should let you know that I worked with his wife, who said good things about me (so you don't think that I don't really know these people.) Mr. Tarbert's career started at a law firm, where he worked from 2003-2005. He then pursued clerkships and government positions between 2005 and 2010, which led to his first chance to make a lot of money, as a partner at Weil, Gotshal & Manges. That didn't work out as he seemingly couldn't find clients. I say that based on this quote in the legal website Above the Law, in which someone who knew him said he had to leave Weil because the firm "didn’t support his efforts to develop" a practice. This friend may have been right. It might have been a lack of support. Regardless, he couldn't "make it rain" at Weil and so he had to leave.

So in 2014 he went to Allen & Overy. Seeing how dead our bank regulatory practice was at O'Melveny, I wrote him in 2015 to ask how it was there. He replied that it was very slow, and that they were not looking for anyone. My boss at O'Melveny Brian Boyle confirmed this. He said I could speak with some higher-up at Allen & Overy if I wanted to see how bad they were struggling. So apparently, Mr. Tarbert hadn't learned how to bring in clients and projects at Allen & Overy either.

So not surprisingly, he left Allen & Overy in 2017 to join the Trump administration, and he didn't return when those political appointments ended. Instead, he joined Citadel Securities, the very wealthy market maker, where he is presumably doing well for himself. That's similar to what Bimal did. He tried to monetize a government position into a lucrative and stable long-term salary, failed, and went back into government to try again until he achieved his goal.

Or consider Kathryn Ruemmler, the general counsel of Goldman Sachs. Her career also evidences a possible desire to monetize government, as she went from the law firm of Latham & Watkins, to government, and back to Latham, to government, and back. Then, after an interesting event, she moved from Latham to Goldman Sachs. According to this article, in July of 2019 she appeared at Jeffrey Epstein's court hearing. One source described it as "probably" "a show of support" for Mr. Epstein, with whom she had a “professional relationship." She sat behind Mr. Epstein's legal team in court. Her time at Latham ended shortly thereafter and she joined Goldman Sachs in 2020. You didn't misread that. She felt she had to take time out of her day and go into court to publicly support Mr. Epstein. A letter or phone call wasn't enough for her. She wanted to really be there for him. And this isn't the first time she supported this sort of person. That's the general counsel of Goldman Sachs.

If you would like other examples, consider Bank of America's former general counsel David Leitch, who also cycled in and out of high-level government positions. He wrote me to tell me there was no room for me at his organization, because I had protested his friend Brian Boyle's torture advocacy, attacks on the Geneva convention and reported dishonesty in federal court. That was Bank of America's general counsel.

Or consider Brian Brooks, who was the general counsel at Fannie Mae and Coinbase, and his attempt to convert his government job into a cryptocurrency fortune (links one and two.) He may very well have destroyed the lives of some who invested in crypto as a result of his efforts. Recently, there have been numerous articles about crypto-related suicides.

Or consider Ryne Miller. He parlayed years of experience at the CFTC, including as counselor to its Chair Gary Gensler, into a partnership at the law firm of Sullivan & Cromwell and then a general counsel position at decabillionaire Sam Bankman Fried's cryptocurrency exchange. [Addendum: A coworker later filed an affidavit attesting that Mr. Miller was hired because he "emphasized his close relationship with [SEC Commissioner Gary Gensler] at every possible opportunity."]

I could give you other examples but I'll stop here. Hopefully by now you are starting to understand the culture of banking law. If you told lawyers in other areas that they shouldn't use a government position for their personal pecuniary benefit, they might agree with you. In banking law, they would laugh at you.

With that background on banking lawyers, let me move to the main topic of this post: Jerome Powell, the current Chairman of the Federal Reserve. Like the people above, Mr. Powell started his career in lower-level positions in law firms and a bank. Then in 1990, he entered the Department of Treasury. That's when the money started rolling in. He parlayed that government position into his first lucrative job, as a managing director of Bankers Trust, which he joined in 1993. That didn't go well. He "quit his position at Bankers Trust in 1995, after the bank became embroiled in a trading scandal that cost its clients hundreds of millions of dollars." But he was fine. He moved to other high-paying banking and investing jobs until returning to government after the 2008 financial crisis. Standard revolving door playbook.

In 2018, the president put Mr. Powell in charge of managing the nation's inflation and employment rate. It was only the second time in history that a lawyer was picked for the position of Chairman of the Federal Reserve. Usually the position goes to an economist. The only other time a lawyer was nominated was in 1978, when Cravath, Swaine & Moore alumnus G. William Miller took the position. Hold onto that year of 1978 as we'll get back to it later. Any way, in 2020, Mr. Powell inexplicably declared a new approach to inflation called "average inflation targeting." Basically, he would be easier on inflation than were prior Fed Chairs. I'm not sure why he changed something that had worked for decades; he claimed it would be good for the country.

It wasn't. Just two years later, inflation is the highest it's been in 40 years. And while some argue that this is temporary, we don't know what will happen. As you can see in the graph below, right now the two key metrics -- actual inflation and inflation expectations (a survey of where people think inflation will go) are where they were in 1978, before a four year period of very high inflation and two recessions. When I started working, older employees would tell me about that time, about how "PhDs had to drive taxi cabs to survive." It was a bad time economically.

I am not making any predictions and I hope we don't repeat the late seventies. But in at least one analogous point in the past, 1978, things got much worse before they got better. So anyone guaranteeing that inflation will quickly subside and that we'll avoid a recession has one counterexample to explain away. Here is the source data if you would like to play with it. I also included the "10-2" (a number that, when it goes negative, predicts a recession, as it did in 1978, and which is currently negative) along with the federal funds rate (the interest rate that is set by the Federal Reserve and Mr. Powell, which is anomalously low in light of where it was relative to inflation historically.)

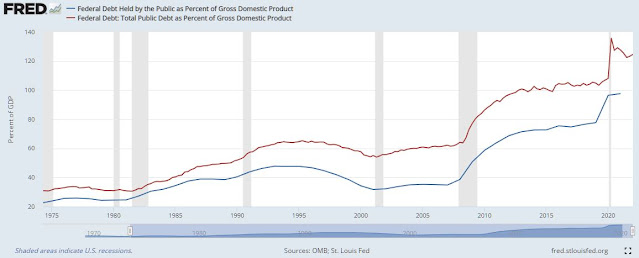

Some commentators wonder if the Federal Reserve can even raise interest rates to lower inflation, as it did in 1980, because the government is more indebted today. Per the graph below, government debt as a percentage of GDP is four times what it was back then. They say that raising rates will raise the government's debt payment, and so is not sustainable beyond a small raise. (Others say that rate increases are sustainable in the short-term, and that a short-term raise is all that's required to lower inflation. Also, a lot of this debt is long-term debt whose interest payment doesn't change as short-term rates increase, and whose value will go down as interest rates rise.) Depending on how this dynamic plays out, the situation might be worse now than it was in 1978.

As you can see, Mr. Powell's decision to go soft on inflation may have been a regrettable mistake. By letting the inflation genie out of the bottle, he might have created a problem that will be painful to fix.

Hopefully things magically resolve. Still, the president may wish to think twice before appointing another lawyer to the position of Federal Reserve Chair. As I explained here, lawyers aren't necessarily interested in the truth. Their job is to cherry pick facts and laws, and spin them to advance their client's interest. Sometimes, this means obfuscating and distracting from the truth. And yes, cherry picking and spinning, being deceptive, being intellectually dishonest . . . these can be useful skills in life. They're very effective in court, in sales, and other areas where one has to be an advocate. But they're not really useful for a Federal Reserve Chair.

Kathy Ruemmler Goldman Sachs, Kathryn Ruemmler Latham Watkins, Kathy Ruemmler Obama attorney