A compilation of news clippings to help you understand this firm. By a former O'Melveny attorney, law professor and Wall Street Journal Lawyer of the Year.

December 11, 2021

Winners and losers in America's opioid era

November 29, 2021

O'Melveny's suspicious "independent investigation" prompts a coordinated response

November 20, 2021

Bimal Patel got his money at PayPal

Bimal Patel Paypal email

November 3, 2021

New rape accusation shows why O'Melveny's "independent investigations" aren't trustworthy

October 23, 2021

O'Melveny embarrasses their client with a reportedly "absurd" letter

October 11, 2021

Why I can't expand this site beyond O'Melveny & Myers

September 23, 2021

O'Melveny's generous perquisites

It's important to know that running wheels are not necessarily a model for a healthy lifestyle. In short, running wheels are a drug. Mice placed in a complex maze of 230 meters of tunnels including water, food, digging material, nests -- in other words a big area with a lot of cool stuff to do -- as well as a running wheel, will spend much of their time on the running wheel and leave large segments of the maze unexplored. Once rodents start using a running wheel, it's hard for them to stop. Rodents run much farther on a running wheel than they do on a flat treadmill or in a maze, and also much farther than they do during normal locomotion in natural environments. Caged rodents given access to a running wheel will run until their tails are permanently curved upward and back towards their head in the shape of the running wheel. The smaller the wheel, the sharper the curve of the tail. In some cases rats run until they die.

September 11, 2021

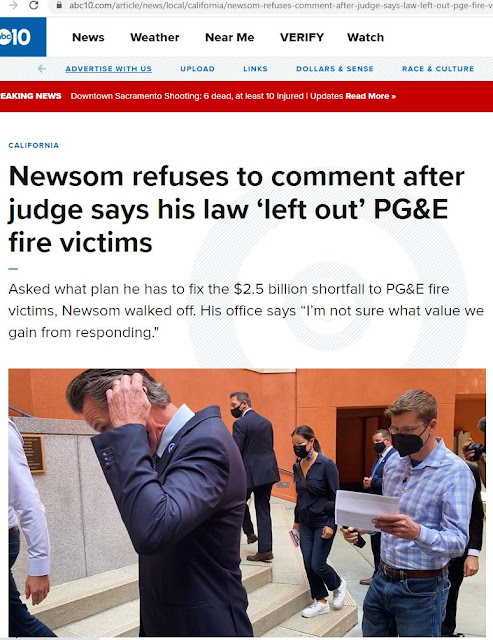

After relying on O'Melveny, California's governor gets blamed for a needless two billion dollar loss

If this had been in place during the 2017, 2018 and 2019 fires, PG&E shareholders would have been on the hook for about $4 billion dollars, not for the tens of billions that they've ultimately ended up paying out[.]

quoting Nathaniel Skinner, Ph.D., Safety Branch Program Manager at the California Public Advocates Office. This article explains how O'Melveny allegedly "watered down" the bill to harm consumers. It's based on the reporter's review of confidential emails between the governor's office and O'Melveny.

In summary, if the reports linked above are right, then O'Melveny and Gov. Newsom's work hurt existing victims to the tune of $2.4 billion, and it could hurt future victims by untold amounts.

[Addendum: A follow-up article argues that O'Melveny was conflicted, because they represented PG&E prior to being hired by the governor's office to protect the state's and victims' interests.]

August 9, 2021

O'Melveny's friend Thomas Barrack got arrested for doing something ingrained in O'Melveny's culture

July 28, 2021

McDermott, Will & Emery shows how easy it is to game Firsthand/Vault's "best firm to work for" award

June 3, 2021

Follow-up to the Brian Brooks and Bitcoin post

May 28, 2021

Brad Butwin's Jewish privilege

As I watched news reports about the 2023 Israel-Gaza conflict, I saw that Israel's Prime Minister Netanyahu had cited an "Amalek" passage as a precedent or model for what should be done in Gaza. In reading up on this topic, I saw a list of Jewish scriptures that (a) identify children as a category and (b) either rationalize their murder, or explicitly tell followers to murder them. Surprised, I checked each citation, and indeed the list was accurate.Note I didn't say scripture rationalizing or ordering the murder of adults. There are too many of those to list. These specifically identify children as a category of people, and as the target. One of them is the story of Judaism's most important holiday, Passover, about how the Jews were freed from slavery via the mass-murder of children that night. In another one, "boys" were "mauled" because they called a man "baldy." (As I read this ridiculous passage, my mind wandered to Larry David, the famous bald Jewish comedian, wondering if he could do an episode on it.)And I use the word murder, or unjustifiable killing, intentionally. Children are too young to understand right and wrong, to understand morality, or be "evil" or "guilty" or whatever — so there can't be a defensible or lawful reason to target them. I've researched this further and can't find a worthwhile explanation for why these passages exist.Regardless, I find it hard to believe that something wise enough to create a universe that contains hundreds of billions of galaxies, with one such galaxy being our Milky Way, which itself contains countless solar systems, one of which is our solar system with the Sun and Earth ... I find it hard to believe that the thing that either created all of that or designed its blueprint to be set in motion by the Big Bang — I find it hard to believe that this creator actually said these things. I also wonder if this is why Judaism has largely failed as a religion, with only about 15 million or so adherents, compared to billions in others. Who wants to hear such ideas?I'm guessing that these scriptures were written in a time when, perhaps, child murder was more common, or perhaps written by a group that fetishized that act. I don't know. This is not to say that Jews have an inclination to murder children obviously. That's absurd and can easily and undeniably be refuted with data. But I do wonder if these passages, and Mr. Netanyahu's statement, might lead Israeli Defense Force soldiers to be more careless with the lives of children, than they would be if these passages did not exist.Anyway, the passages are below, with citations to their source.

Now go, attack the Amalekites and totally destroy all that belongs to them. Do not spare them; put to death men and women, children and infants, cattle and sheep, camels and donkeys. 1 Samuel 15:3.

Happy is the one who seizes your infants and dashes them against the rocks. Psalm 137:9.

From there Elisha went up to Bethel. As he was walking along the road, some boys came out of the town and jeered at him. “Get out of here, baldy!” they said. “Get out of here, baldy!” He turned around, looked at them and called down a curse on them in the name of the Lord. Then two bears came out of the woods and mauled forty-two of the boys. 2 Kings 2:23-24.

At that time Menahem, starting out from Tirzah, attacked Tiphsah and everyone in the city and its vicinity, because they refused to open their gates. He sacked Tiphsah and ripped open all the pregnant women. 2 Kings 15:16.

A prophecy against Babylon that Isaiah son of Amoz saw: . . . Their infants will be dashed to pieces before their eyes; their houses will be looted and their wives violated. Isaiah 13:16.

At midnight the Lord struck down all the firstborn in Egypt, from the firstborn of Pharaoh, who sat on the throne, to the firstborn of the prisoner, who was in the dungeon, and the firstborn of all the livestock as well. Pharaoh and all his officials and all the Egyptians got up during the night, and there was loud wailing in Egypt, for there was not a house without someone dead. Exodus 12:29-30.

They devoted the city to the Lord and destroyed with the sword every living thing in it—men and women, young and old, cattle, sheep and donkeys. Joshua 6:21.

Now therefore kill every male among the little ones, and kill every woman that hath known man by lying with him. But all the women children, that have not known a man by lying with him, keep alive for yourselves. Numbers 31:17-18.

However, in the cities of the nations the Lord your God is giving you as an inheritance, do not leave alive anything that breathes. Deuteronomy 20:16.

And he that curseth his father, or his mother, shall surely be put to death. Exodus 21:17.

And all the men of his city shall stone [your son] with stones, that he die. Deuteronomy 21:21

[K]ill, without showing pity or compassion. Slaughter the old men, the young men and women, the mothers and children . . .. Ezekiel 9:5-6.

We completely destroyed them . . . men, women and children. But all the livestock and the plunder from their cities we carried off for ourselves. Deuteronomy 3:6-7.

[A]nd when the Lord your God has delivered them over to you and you have defeated them, then you must destroy them totally. Make no treaty with them, and show them no mercy. Deuteronomy 7:2.

The people of Samaria must bear their guilt, because they have rebelled against their God. They will fall by the sword; their little ones will be dashed to the ground, their pregnant women ripped open. Hosea 13:16.

[W]ere they to bear children, I would kill the darlings of their womb. Hosea 9:16.

[S]he went into captivity: her young children also were dashed in pieces at the top of all the streets. Nahum 3:10.

Prepare slaughter for his children for the iniquity of their fathers[.] Isaiah 14:21.

I will burn up the house of Jeroboam as one burns dung, until it is all gone. Dogs will eat those belonging to Jeroboam who die in the city, and the birds will feed on those who die in the country. . . . As for you, go back home. When you set foot in your city, [your] boy will die. 1 Kings 14:12.

[I]f they rear children, I will bereave them of every one. Hosea 9:12.

After they had stoned [Achan and his sons and daughters], they burned them. Joshua 7:24-26.

I will punish them. Their young men will die by the sword, their sons and daughters by famine. Jeremiah 11:22.

And the company shall stone them with stones, and dispatch them with their swords; they shall slay their sons and their daughters, and burn up their houses with fire. Ezekiel 23:47.

[T]he sons and daughters born in this land . . . will die of deadly diseases. They will not be mourned or buried but will be like dung lying on the ground. They will perish by sword and famine, and their dead bodies will become food for the birds and the wild animals. Jeremiah 16:3-4.

Jephthah made a vow to the Lord: “. . . whatever comes out of the door of my house to meet me when I return . . . I will sacrifice it as a burnt offering.” . . . When Jephthah returned to his home in Mizpah, who should come out to meet him but his daughter . . . “My father,” she replied, “you have given your word to the Lord. Do to me just as you promised" . . . [H]e did to her as he had vowed. And she was a virgin. Judges 11:30-39.

Then David said to Nathan, “I have sinned against the Lord.” Nathan replied, “The Lord has taken away your sin. You are not going to die. But because by doing this you have shown utter contempt for the Lord, the son born to you will die.” 2 Samuel 12:13-14.At that time we took all his towns and completely destroyed them—men, women and children. We left no survivors. Deuteronomy 2:34.

[P]ut to the sword those living there, including the women and children. Judges 21:10.

He also put to the sword Nob, the town of the priests, with its men and women, its children and infants, and its cattle, donkeys and sheep. 1 Samuel 22:19.

You shall not bow down to them or worship them; for I, the Lord your God, am a jealous God, punishing the children for the sin of the parents to the third and fourth generation of those who hate me. Exodus 20:5.

[A]s Shalman devastated Beth Arbel on the day of battle, when mothers were dashed to the ground with their children. Hosea 10:14.

[Y]ou will eat the fruit of the womb, the flesh of the sons and daughters the Lord your God has given you. Deuteronomy 28:53.

And ye shall eat the flesh of your sons, and the flesh of your daughters shall ye eat. Leviticus 26:29.

And I will cause them to eat the flesh of their sons and the flesh of their daughters. Jeremiah 19:9.

Therefore in your midst parents will eat their children, and children will eat their parents. I will inflict punishment on you. Ezekiel 5:10.

This woman said to me, ‘Give up your son so we may eat him today, and tomorrow we’ll eat my son.’ So we cooked my son and ate him. 2 Kings 6:28.

With their own hands compassionate women have cooked their own children, who became their food when my people were destroyed. Lamentations 4:10.]

- Regarding the Amalek passage above (1 Samuel 15:3, which says to "put to death men and women, children and infants . . ..") -- 65% of respondents said it's relevant today and, of those, 93% said the IDF should use the same tactics.

- Regarding another passage above (Joshua 6:21, which talks about "destroy[ing] with the sword every living thing in [a city]—men and women, young and old . . ..") -- 47% of respondents said the IDF should use the same tactics.

- The vast majority of Israeli society wants Gazans to be forcibly expelled. Overall, 82% of respondents agreed with that statement, including 70% of secular Jews and over 90% of ultra-Orthodox Jews. Only 9% of Jewish men under 40, the demographic most likely to serve in the IDF, opposed forced expulsion.

- Finally, 56% of respondents also want Israeli Arabs expelled from Israel.